By Geoffrey Cain

Forbes

Mar 13, 2020

In 2005, Chang-Gyu Hwang—president of Samsung’s semiconductor and memory business—traveled with two fellow executives to Palo Alto, to the home of Steve Jobs.

“I met him with the solution to Apple’s life-or-death problem hidden deep in my pocket,” Hwang wrote.

In the course of their meeting, he pulled out the NAND flash memory, as it was called, and put it on the table. He called it “my trump card.”

His pitch? Flash memory was a much more lightweight and efficient storage device than the traditional hard disk. And Samsung was one of few companies that could guarantee a rock-solid supply.

“This is exactly what I wanted,” Jobs said of Samsung’s flash memory, according to Hwang. He agreed to make Samsung the sole supplier of flash memory for the iPod.

“It was the moment that marked the beginning of our dominance in the U.S. semiconductor market,” Hwang wrote. With that, Samsung had a launchpad from which to eventually get into smartphones, when they came out.

They would go from supplier to competitor.

Jobs was livid when Samsung released its smartphone in 2009. As he told biographer Walter Isaacson, he wanted to launch “thermonuclear war” on Android, the operating system used in Samsung phones. Samsung was the Apple iPhone chip supplier that dared to compete directly against Apple by making a similar-looking smartphone, and with the Android operating system, which Jobs abhorred. Jobs was prepared to sue. Tim Cook, as Apple’s supply chain expert, was wary of endangering the relationship with a supplier that Apple depended on.

When Samsung vice chairman Jay Lee—who was then the company’s chief customer officer—visited the Cupertino campus, Jobs and Cook expressed their concerns to him. Apple drafted a proposal to license some of its patents to Samsung for $30 per smartphone and $40 per tablet, with a 20 percent discount for cross-licensing Samsung’s portfolio back to Apple. For 2010 that revenue would have come to $250 million.

JUSTIN SULLIVAN/GETTY IMAGES (LEFT); SIMON DAWSON/BLOOMBERG

In the end, Samsung’s lawyers reversed the offer. Since Apple was copying Samsung’s patents, they argued, Apple had to pay Samsung.

In April 2011, Apple filed multiple lawsuits, spanning dozens of countries, against Samsung for patent infringement. It demanded $2.5 billion in damages. Samsung quickly countersued for infringement of five patents relating to its wireless and data transmission technology.

The war was on.

Samsung executives felt Apple was trying to create a monopoly with generic patents like the iPad’s black rounded rectangle shape, a patent so silly that a court threw it out. “We are going to patent it all,” Jobs once said. He also blatantly mocked Samsung and other competitors, calling their larger phones “Hummers.” “No one’s going to buy that,” he said at a press conference in July 2010.

Samsung’s management team didn’t take Jobs’ attack lightly.

“I am talking to you on a phone right now that Apple just copied,” Brian Wallace, Samsung’s former vice president for strategic marketing, told me years later. “I’ve got a Note Edge. It’s a giant fuckin’ phone that Steve Jobs made fun of. Who was right? Samsung was right.”

Samsung’s greatest strength was its ability to manufacture superior hardware, faster than any of its competitors, through its vast, strict, top-down management system and its superior supply chain.

But the work of the marketers at Samsung was frustratingly subpar.

Samsung didn’t use people in its commercials—“just product and voiceover and talking about the product benefit,” said Samsung’s chief marketing officer, Todd Pendleton. Rather than pitch consumers on why Samsung was great, marketing stories were framed around the telecom carriers—“telling a story around their network and why their network is great.”

The South Korean headquarters, meanwhile, sent over goofy and culturally inappropriate commercials that incited rebellion among the Americans on staff. “They wanted us to use butterflies,” said former marketing vice president Clyde Roberson. He called the ads “Hello Kitty.”

“I am talking to you on a phone right now that Apple just copied,” said Brian Wallace, Samsung’s former vice president for strategic marketing. “It’s a giant phone that Steve Jobs made fun of. Who was right? Samsung was right.”

“We need more creativity!” Dale Sohn, the CEO of Samsung Telecommunications America, the Texas mobile phone office, exclaimed in a meeting in 2010, according to a senior manager who was present. Dale reported to mobile chief J.K. Shin. He had been tasked with turning things around in America, Samsung’s toughest market, given the iPhone’s huge popularity. “I want someone who’s got tattoos all over his arms and earrings!”

When Dale put out a call for a new chief marketing officer, a headhunter zeroed in on Pendleton. Pendleton had been an unconventional marketer at Nike, an impresario and master brand builder. He had been offbeat and irreverent in the ads he crafted and sharp and to the point in the way he communicated.

Todd, however, had never worked at a tech company before and didn’t know the industry. As a tech specialist, the company reached out to a former BlackBerry digital marketer named Brian Wallace.

Pendleton and Wallace quickly got to work. The two marketing executives brought aboard thirty-six marketers and treated the office as a black-box operation. “We had to be somewhat insular to be able to pull some of this stuff off,” said a team member. They were worried about meddling from South Korea’s bureaucracy. Dale provided air cover from headquarters, giving them an unusual degree of latitude and space to get their work done.

In 2011, at Samsung’s U.S. headquarters, Pendleton gathered about fifty people into a meeting. He approached the whiteboard and wrote: “Samsung = ?”

“Who are we?” he asked. “What do we stand for?” Then he went around the room and asked everyone to fill in their idea. “I got about 50 different answers,” he said. For Todd Pendleton, it was alarming. “If we can’t answer [that] as employees, consumers are not going to know who we are.”

On a chart of competitors in their space, with “style” for the vertical and “innovation” for the horizontal axis, they placed Apple and Sony in the upper-right quadrant, marking them as both stylish and innovative.

Samsung, on the other hand, still lacked brand power: It was raised only slightly on the style axis, while it was far to the left on the innovation axis. In other words, consumers saw Samsung as having little of either. “Less stylish, less innovative.” “More functional.” “Good quality and value.” With Apple and Sony commanding and fiercely protecting that stylish and innovative space, could Samsung find an opening?

In focus groups and surveys, the marketers noticed, there was a growing divide between two camps: those who used Apple’s iPhones and those who used smartphones from HTC, Samsung, and Nokia, which ran Google’s quickly growing open-source operating system, Android.

SMITH COLLECTION/GADO/GETTY IMAGES

“Android people consider themselves to be smarter than Apple people,” a marketer under Todd concluded from his data. In fact, the team had to split up focus groups that included both Apple and Android fans, as they’d get particularly raucous and unproductive. There was always at least one Apple fan in the room who scolded the Android fans, and vice versa, with Android users pointing out how much more flexible and customizable their operating system was. “There was this growing base of Android users who could become a tribe,” Brian Wallace said, crunching a new trend in the social-media chatter. “But they needed a leader.”

Samsung wanted to be that leader.

Pendleton showed his colleagues side-by-side hardware comparisons between the iPhone and the Galaxy phone in The Wall Street Journal, which showed Samsung leading in a number of areas. The problem was that Samsung, up to this point, was not attempting to tell a story. Apple was commanding the narrative: It had the cult of Steve Jobs, a massive following, and glowing media coverage, and it had unleashed a barrage of aggressive legal action arguing that Samsung was a copycat in terms of new products and innovation.

By attacking Apple head-on, Samsung’s marketers thought they could establish themselves as the challenger brand, turning the competition with Apple into a Coke-versus-Pepsi war for the smartphone world. But how do you attack Apple without looking petty, without giving it free advertising, without acting like the smaller dog in the pack who barks the loudest and then gets laughed at?

The team turned to a consultant named Joe Crump, senior vice president for strategy and planning at Razorfish, one of the world’s largest interactive agencies, to help them convey the depth of the brand problem in America to Samsung’s senior executives. Crump had an idea to get that across: He’d send camera crews around Times Square, each carrying two duffel bags. The first bag, people on the street would be told, contained the next unreleased iPhone. The other had a Samsung phone.

“What would you give us for each?”

Here was the response to the question when they thought the bag contained the new, unreleased iPhone: “I’d give you my brand new BMW. . . . I’d give you ten thousand dollars. . . . I’d give you my sister.” And the response for the Galaxy: “I don’t know. Five bucks?” One guy offered his half-eaten ice cream cone.

“The Samsung [response] was just blistering,” Brian recalled. “We had to even take some of it out because it was just so harsh.”

A visiting delegation of South Korean executives huddled in a conference room to watch the video of these Times Square interactions. They were aghast. Suddenly Pendleton had their ear. The research—the field testing—had been done for internal consumption only. It was designed by Pendleton to get the South Korean executives to grasp the size of the problem.

Step two was to ensure that the economics of the coming marketing war on Apple made sense. Samsung had built a carrier-driven model, jumping through hoops to ensure that Sprint and AT&T received their own customized Galaxy phones to sell, using Samsung’s marketing money. If Todd pulled a maneuver too soon, swarms of customers might show up at AT&T stores—AT&T was the exclusive carrier for the iPhone at the time—only to have the advertising throughout the stores nudge them toward Apple.

The solution? To redirect Samsung’s marketing budget. At the time, Samsung was putting about 70 percent of its U.S. smartphone budget in so-called marketing development funds (MDFs), which were cash piles allocated to the carriers for advertising and rebates. About 30 percent of the budget went to Samsung’s own branding efforts. Pendleton’s team convinced Dale Sohn to reverse the figures: to put 70 percent behind Samsung’s own efforts and devote 30 percent to the carriers.

“What would you give for the new, unreleased iPhone? “I’d give you my brand new BMW. . . . I’d give you ten thousand dollars. . . . I’d give you my sister.” And the response for the Galaxy? “I don’t know. Five bucks?”

Once Samsung had the marketing budget to reach out directly to customers, Pendleton could initiate step three: hiring an ad agency. He annoyed Samsung headquarters by going around their established Madison Avenue and Seoul agencies and instead putting in a call to relative newcomer 72andSunny, a boutique advertising firm with offices in Los Angeles, New York, and Amsterdam that had a special zing for cultural marketing.

Todd’s team chose 72andSunny specifically for its edginess. On a conference call with 72andSunny, he laid out Samsung’s goal, as handed down by Dale Sohn.

“I expect us to be number one in a couple years.”

The creative executives at 72andSunny got to work and churned out their first approach for Pendleton, who was present at the shoots and the editing, eager to maintain his creative hand. In one early version of a commercial, two characters waiting in line outside an Apple store had a conversation about the features and quality of their Apple and Samsung phones, followed by a cut to another scene of two characters talking about their phones.

It was slow, boring, and dull. Samsung’s bid to take on Apple, Todd’s team feared, would be finished before it had even started.

“We don’t have a campaign here, guys,” Pendleton said.

With the holiday shopping season closing in, the only solution was to chop up and redo the film then and there. During a frantic all-nighter, someone in the room suggested that they turn the commercial into a single scene, rather than two separate, awkward, forced moments of chatter between disparate characters.

The new commercial was completed the next afternoon.

It started, as before, with a line of apparent Apple lemmings waiting all night around a street corner for the release of the next big iThing—presumably an iPhone, though Apple was never mentioned by name.

“Guys, I’m so amped I can stay here for three weeks,” says an apparent Apple idolater.

No longer was the smartphone war a battle between Apple and a tangle of obscure Android me-too phones. Now it was a two-horse race. Everyone else had fallen by the wayside.

One guy notices a woman on a sidewalk tapping away at some weird gadget that—what?—doesn’t look like an iPhone.

“Whoa, what does she got there?”

Then another pedestrian hails a taxi on the sidewalk, holding the mystery device.

“Hey, bro, can we see your phone?” The mob of Apple fans snatch the device and pore over its hardware and features. “It’s a Samsung Galaxy,” the pedestrian tells them. “Check out the screen on this thing—it’s huge.”

What is this thing?

“It’s a Samsung,” they repeat to each other. “Samsung?”

“It’s a Galaxy S II. This phone is amazing,” says the Samsung guy, showing off his smartphone before getting into a taxi, bidding farewell to the crowd of Apple zombies.

The message? You don’t need to wait in line. You don’t need to follow the hype.

“The Next Big Thing Is Already Here,” the commercial finishes.

“God damn!” Todd exclaimed after looking at it. “We’ve got a campaign!”

Pendleton’s staff sent the commercial to South Korea for approval. Five days later, they’d still heard nothing back. At six o’clock on day five, Dale Sohn stood up, put on his jacket, and got ready to go home, before leaving a word of advice on the silence from Seoul.

“It means they’ve given you enough rope to hang yourself,” Sohn said.

It was up to Todd’s team to make the leap and take the risk. And if it failed, they’d have to answer for it.

They proceeded to leak the film to the popular tech and culture website Mashable, which unveiled it on November 22, 2011, before Samsung posted it “officially” on its Facebook page later that day. Pendleton was abandoning the marketing world’s older, more vanilla strategy of going through print and TV news outlets, opting for the Web first, appealing to millennials. Then, on Thanksgiving weekend, the commercial debuted in minute-long spots during the NFL games.

MARION ETTLINGER / PENGUIN RANDOM HOUSE

The campaign was a phenomenal success, beyond anything the team had anticipated; Samsung had hit precisely the sweet spot, with viewers responding that they were tired of swallowing what they thought was Apple’s unjustified pretentiousness. The commercial transformed Samsung Telecommunications America into one of the fastest-growing brands on Facebook, with more than 26 million fans in sixteen months.

“We are the fastest-growing brand globally on Twitter, with almost two million followers,” Pendleton later recounted at a press conference.

“Get ready to take out your designer pitchforks, Macheads. Your hipness is under attack as we speak,” joked CBS’s Chenda Ngak.

During the third quarter of 2011, Samsung surged past Apple to the number one spot among phone manufacturers, based on shipments. No longer was the smartphone war a battle between Apple and a tangle of obscure Android me-too phones. Now it was a two-horse race. Everyone else had fallen by the wayside.

Trucks carrying fresh apples started arriving at the Texas headquarters of Samsung. Bushel baskets were placed in the elevator banks and break rooms, so that wherever Samsung employees took a coffee break, they were reminded of their mission—to take a bite out of Apple.

Excerpted from Samsung Rising: The Inside Story of the South Korean Giant That Set Out to Beat Apple and Conquer Tech © 2020 by Geoffrey Cain. Published by Currency, an imprint of Penguin Random House LLC. No part of this excerpt may be reproduced or reprinted without permission in writing from the publisher.

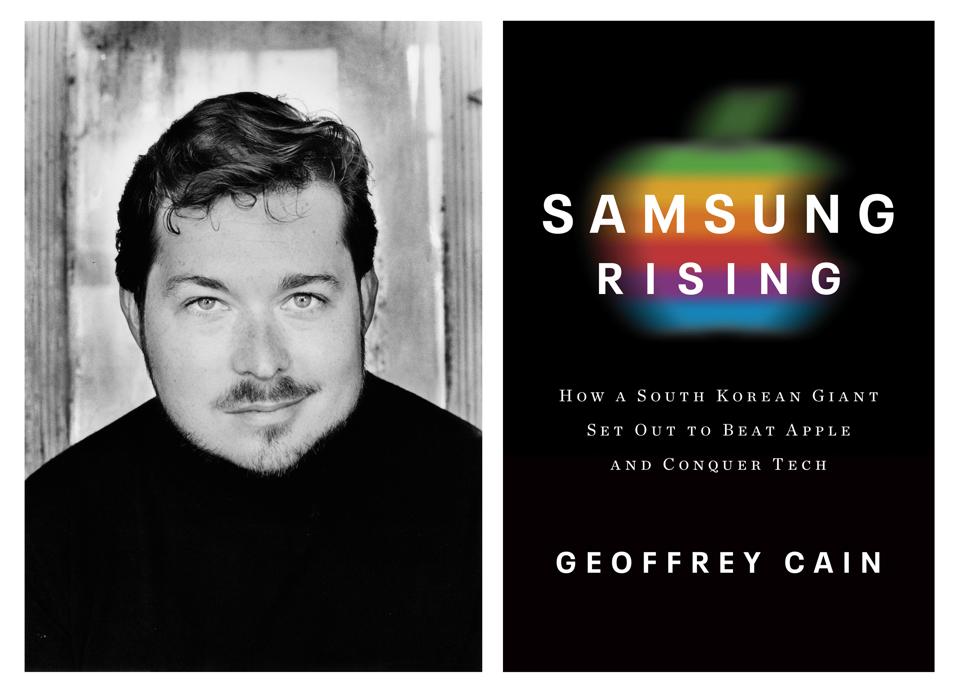

Geoffrey Cain is a foreign correspondent and author who has covered Asia and technology for The Economist, The Wall Street Journal, Time, The New Republic, and other publications. A resident of South Korea for five years and a Fulbright scholar, he studied at the School of Oriental and African Studies in London and the George Washington University. He is a term member of the Council on Foreign Relations.

COVER PHOTO-ILLUSTRATION BY FORBES/ BLOOMBERG NEWS

The article was originally published in Forbes